Whitepaper Overview

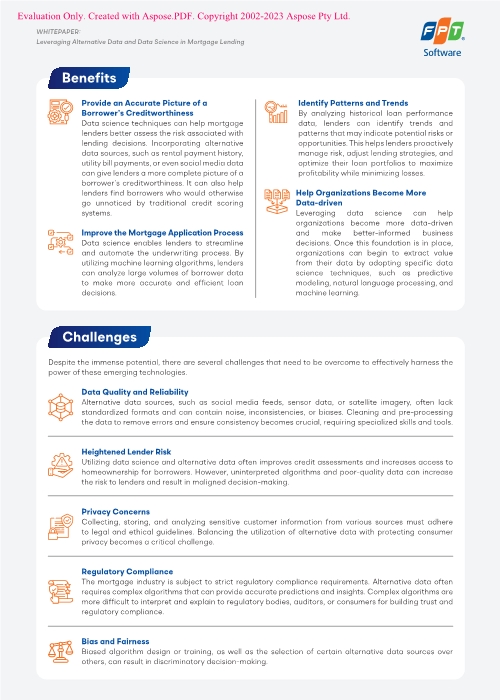

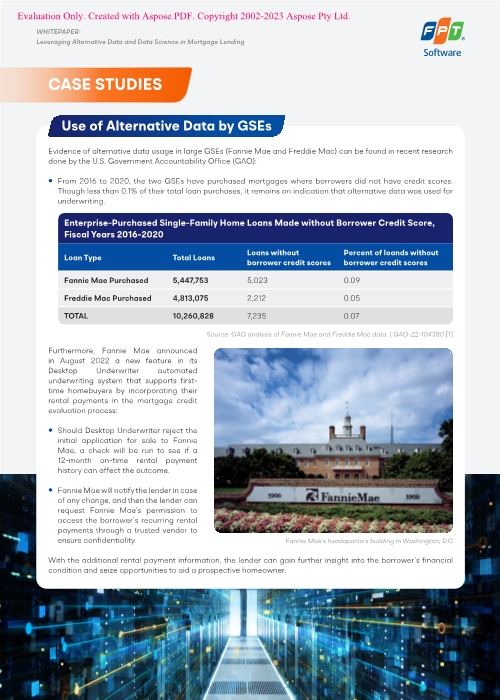

In today's technologically advanced era, data science and alternative data play a critical role in enhancing homeownership accessibility. This whitepaper delves into their application in mortgage lending, highlighting advantages such as accurate creditworthiness assessment and process enhancement while addressing challenges like data reliability, lender risk, privacy concerns, and regulatory compliance. Furthermore, it provides insights into effective data collection, integration, and regulatory adherence for mortgage underwriting. By effectively leveraging these technologies, mortgage lenders can offer tailored solutions, make accurate decisions, and promote broader homeownership, fostering thriving communities.

Preview

Download Full Version of the White Paper

Free Download