In recent years, the insurance sector has encountered various challenges, including lead management, security breaches, and manual sales processes, which highlight the need for advanced digital solutions. Therefore, FPT Software has fostered strategic partnerships with insurance leaders, including AIA and Manulife, to effectively address communication challenges, improve time management, and boost operational efficiency.

Empowering agents with digital solutions

Improving customer engagement remains a top priority for insurers in today's digital landscape. Specifically, research by PwC indicates that 73% of consumers say customer experience is an important factor in their purchasing decisions. A platform should be available and accessible in different forms, including desktop, mobile, and tablet. Not only that, a user-friendly and intuitive interface is essential to help users navigate the platform easily. This inclusivity opens the door for a wider range of agent demographics, fostering a more diverse and engaged client base.

Therefore, leveraging data analytics is critical for insurers to streamline operational processes and enhance overall customer experiences. Data analytics will facilitate decision-making processes throughout the customer journey, from initial awareness to final transactions. In response to this need, FPT Software has introduced Agent Digital Platform (ADP), an integrated solution to empower agents to optimize sales performance and extract valuable customer insights.

Streamlining operations with an all-in-one application

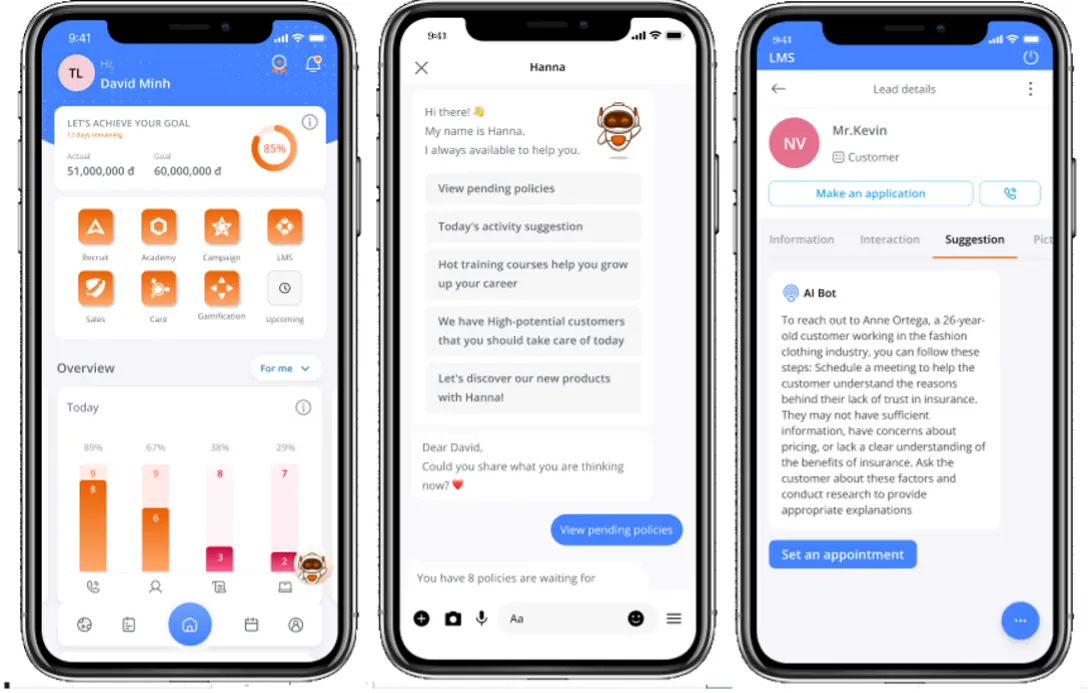

ADP offers a comprehensive super app with functionalities, including Optical Character Recognition (OCR) and electronic Know Your Customer (eKYC) verification. These technologies enable seamless digital onboarding processes, remote training, and certification. Moreover, ADP can help human resource management teams optimize job postings, schedule appointments, and coordinate interviews. These functions can help track performance metrics and dynamic operating management according to staff level. Additionally, incorporating flexible plug-ins as a“mini-app” allows for further customization, ensuring the platform adapts to the specific needs.

ADP can ensure personalized interactions and assist agents in achieving key performance indicators (KPIs) with IvyChat, an activity management tool driven by AI. Additionally, ADP is equipped with automated reporting features to help agents capture critical business metrics in real time. ADP also centralizes lead management and policy submissions to refine agent workflows and boost efficiency through automation.

Security first

Security is critical for the insurance industry. According to PwC’s 2024 Global Digital Trust Insights survey, the proportion of businesses that have experienced a data breach of more than 1 million USD has increased significantly year over year—from 27% to 36%. To mitigate data breaches, ADP helps insurers protect sensitive customer data. With advanced security features, companies can ensure information remains confidential and compliant with industry regulations.

Automated data entry with high accuracy

Human errors from manual entry can be an issue for the insurance industry. According to research, human error rates in manual data entry can range from 1% to 5%, depending on factors such as data complexity and the personnel experience when entering the data. Hence, automated data integration and standardized input formats eliminate errors and streamline processes. This translates to a significant improvement in adapting to the specific characteristics of large data sources from financial companies, allowing agents to easily generate automatic reports and capture critical business metrics in real time.

Comprehensive digital solutions

In addition to ADP, FPT Software provides a wide array of services to support businesses in the insurance industry on their digital transformation journey. These services can help companies leverage advanced data analytics to extract actionable customer behaviors.

FPT Software also offers digital customer service platforms, including CRM and online support systems, to facilitate personalized services and enhance customer satisfaction. Furthermore, advanced data processing and storage solutions can help insurers effectively manage large datasets to enhance processing efficiency.Leading innovations in the insurance sector

With more than 15 years of experience working with leading players in the insurance sector and a commitment to revolutionizing customer engagement through advanced digital solutions, FPT Software aims to further reshape the industry landscape towards a more intelligent and customer-centric future.

About FPT Software

FPT Software, a subsidiary of FPT Corporation, is a global technology and IT services provider headquartered in Vietnam, with $1 billion in revenue (2023) and over 30,000 employees in 30 countries.

The company champions complex business opportunities and challenges with its world-class services in Advanced Analytics, AI, Digital Platforms, Cloud, Hyper automation, IoT, Low-code, and so on. It has partnered with over 1,000+ clients worldwide, 91 of which are Fortune Global 500 companies in Aviation, Automotive, Banking, Financial Services and Insurance, Healthcare, Logistics, Manufacturing, Utilities, and more.