Vietnam is one of the countries with the most potential consumer finance industry in the region as well as in the world. With a young population structure, a large number of Vietnamese enter the labor market each year and their income also increases with each passing year. Therefore, the consumer finance industry in Vietnam is forecast to grow strongly in the future.

Potential of Consumer Credit

Vietnam is considered as a potential consumer finance market when many people still do not have access to and use financial services, especially with the consumer credit market is forecast to expand. Along with increasing consumer demand. There are a number of key factors explaining this outlook: First, Vietnam ranks 14th among the world's most populous countries with a population of about 90 million and a relatively high young population. Second, Vietnam is a developing country with a dynamic economy and people's income growing each year. With a high density of young population and increasing income, the demand for shopping and consumption to improve people's lives has also been constantly increasing.

Even when the macro economy has not fully recovered as at present, the consumer finance industry is still developing very strongly and has a steady growth rate each year. Therefore, when the economic situation is improved, the growth rate of individual consumer credit will increase even more impressively, about 20- 30% / year. In fact, in the past 5 to 6 years, in Vietnam, more and more companies have entered the consumer finance market.

Practical Problems

Currently on the main market in Vietnam, statistics show that unbank accounts for about 80% and only about 20% bank. According to Mr. Nguyen Trung Duc- Bao Kim Electronics’ CEO, the market demand is now 7 times higher than the number of loans disbursed by banks. This shows that the disbursement from the bank does not meet the needs of the borrower, because the demand for capital in Vietnam is high but the management of credit information is not keeping up, requiring verification time KYC.

The Credit Information Center (CIC) and Vietnam Credit Information Joint Stock Company are currently the two entities that own the most financial data in the country. However, these companies only have about 15-20% financial data of Vietnamese people. About 80% of the remaining market is still in the hands of unbank. Traditional customer data management models cannot update information, while customer needs are constantly changing. This will be a big gap to exploit in credit evaluation and scoring.

On the government side, the fact that the majority of credit information is not controlled is partly a factor in which the economy does not create much value and cannot reach out to the globe due to the fact that financial companies do not understand borrowers' information and there are many money laundering activities still going on in Vietnam.

FPT Software and Bao Kim Electronics are starting to develop Blockchain technology in storing shared verification information. However, this requires collaboration from multiple banks and financial companies that can share common data.

(Related: Blockchain Monitoring Portal: Secret Weapon in Blockchain Projects)

Blockchain KYC & Intelligent Credit Scoring Benefits

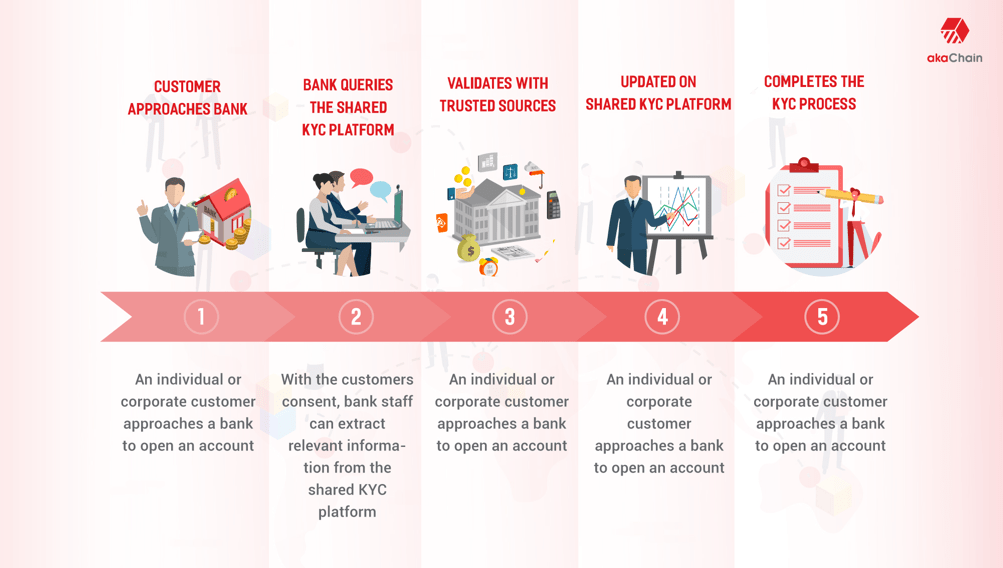

Establishing KYC (Know Your Customer) processes within an organization is a required, tedious procedure. In addition to the large amounts of paperwork associated with such procedures, a lack of transparency regarding the use of the personal data that is collected from customers has led to inefficiencies in collating public data (duplicate data from many sources).

Blockchain-based KYC has many inherent advantages. Many companies are working on a ‘digital signature’ that would keep a secure copy of all your KYC-compliant documents stored on a blockchain. Benefits include:

- Immutability and transparency of blockchain-enabled data allows any member institution to demonstrate to regulators that trustworthy information is provided by the secure blockchain platform.

- Real time up-to-date customer data, including complex business relationships, while maintaining complete data security and privacy of the customer. Each time a participating institution has a KYC transaction, the latest information would be placed in the shared distributed ledger, enabling multiple institutions to rely on the same checks and information up to a minimum standard.

- Greater operational efficiency and the ability to share customer information through a digital process flow. These improvements can significantly reduce the time and effort needed in the early stages of the KYC process, accelerate the onboarding of customers and reduce the corresponding costs of KYC and regulatory compliance.

- From a customer point of view, the use of a KYC utility by financial institutions would improve the customer experience and improve their overall satisfaction by making processes more timely and efficient.It is understandable that customers may have privacy concerns about sharing their personal and financial data.Here, blockchain offers another advantage, with some models giving customers the ability to approve which and when organizations have access to their information. Digital implementation can simplify the approval process, such as forwarding an application for permission to the customer's phone for approval with a one-time password (OTP). Other options, such as smart digital signatures, iris or facial scans may further extend customers’ sovereignty of identity.

For more readings on blockchain and eKYC, click here to explore!