While the digital era opens doors for the banking industry with great growth opportunities, it also brings significant challenges, such as vast amounts of data and changing customer demands. To make breakthroughs, banks need to embrace innovative solutions.

Current challenges in banking

One of the most pressing issues facing banks is the vast amount of data generated from customer transactions, financial information, market data, and more. In 2025, the world is expected to create 181 zettabytes of data. Hence, effectively collecting and processing this massive data volume is a complex challenge that banks must address. Accurate and timely data analysis is critical to making informed decisions, optimizing operations, and enhancing competitive advantages.

In addition, the ever-increasing customer demands pose another challenge to the banking industry. Today's customers want fast and convenient banking services. Indeed, customers are willing to pay more for the experience qualities that matter, with 43% of consumers paying more for greater convenience and 42% paying extra for a welcoming experience. Furthermore, personalization is also critical for banks to retain their customers and adapt to the younger demographics. EY reveals that 81% of Gen Z consumers worldwide identify personalization as a feature that could deepen their relationships with banking institutions.

The explosion of AI in banking

In response to these challenges, the application of AI chatbots in banking operations marks a turning point in the industry's digital transformation. According to KPMG, 61% of banking technology leaders indicated that they believe genAI, AI, and machine learning will be critical to enabling the business to achieve its goals.

The application of AI chatbots in the banking industry is an undeniable digital transformation trend, offering immense growth potential. Effective AI chatbot implementation will help banks improve operational efficiency by automating manual tasks, such as providing prompt answers to common questions and streamlining tasks such as balance checks. Additionally, AI chatbots can enhance customer experience and help bankers make informed decisions. Thus, AI chatbots are gaining more popularity, with 48% of surveyed US bank executives planning to use genAI to enhance customer-facing chatbots and virtual assistants.

Despite its potential, AI is linked to potential risks, such as cybersecurity breaches, with direct and indirect economic and regulatory impacts on the banking industry, leading to significant financial losses and reputation damage. Thus, it is important to remember that AI is a powerful tool that can be used safely with the proper precautions. For example, banks can enhance their security by conducting thorough code reviews, implementing rigorous testing procedures, investing in advanced cybersecurity technologies, and regularly updating their security protocols. Enterprises should also adhere to AI regulations to ensure safe AI deployment and data protection.

Power Insights - A breakthrough AI chatbot solution for banks

Leveraging Microsoft's Azure OpenAI technology foundation, Power Insights is an AI chatbot application utilizing Generative AI to provide robust data extraction, analysis, and visualization capabilities. By directly connecting to a bank's Data Warehouse or Management Information System (MIS) to automatically retrieve data, Power Insights can access and process data about customer transactions, market trends, and more.

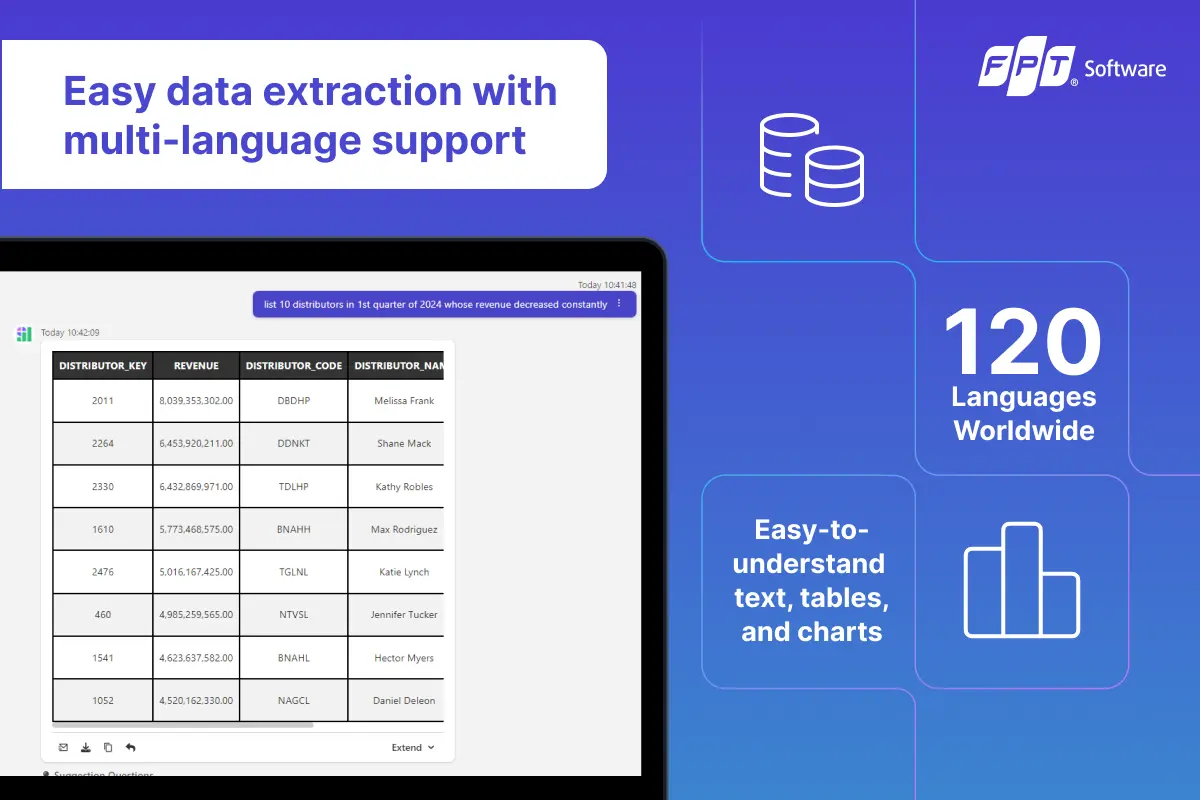

Easy data extraction with multi-language support

Businesses can use Power Insights to extract valuable insights from data through simple conversational language interactions, supporting over 120 languages worldwide, instead of relying on advanced SQL analysis tools or expertise.

This platform can present answers in easy-to-understand text, tables, and charts. Additionally, Power Insights fosters business collaboration by supporting information sharing through popular platforms like Microsoft Teams and Email.

Strict compliance with security regulations

Understanding the security risks associated with Generative AI, the Power Insights AI chat application, researched and developed by FPT Software, is designed to strictly comply with all relevant data protection laws and regulations. Power Insights ensures absolute security with the 3 NOs principle:

- NO reuse for other customers.

- NO use for training any other third-party products or services.

- NO use for training AI models unless customer consent is obtained.

Power Insights – Unleashed efficiency for the banking industry

With Power Insights, banks can:Enhance governance capabilities and efficiency: Power Insights can assist bank managers in extracting insights from data more quickly, accurately, and efficiently. Instead of manually extracting insights from dashboards, Power Insights can connect directly to the Data Warehouse, scan dashboards, and generate data visualizations (in tables and charts) within seconds. This allows managers to make more informed decisions when managing operations and business. Develop products and services: This innovative tool can quickly analyze large amounts of information. Thus, businesses can effectively identify customer needs, providing a basis for creating more specialized products and service packages that are more relevant to users.

Powering the banking industry with innovations

Despite the ongoing challenges in the banking industry, it is also an opportunity for banks to innovate, create, and breakthrough for growth. By adopting advanced technologies, banks can establish their leading position and contribute to the strong development of the digital economy.

To understand more about Power Insights, don’t hesitate to contact us.